盖尔·拉夫特:没有单一货币可以取代美元,但我们正迈向货币多极化时代

导读:俄乌冲突和美西方对俄罗斯举起的制裁大棒引发国际局势剧烈动荡。美国向俄投掷“金融核武器”是张王牌,还是美国自我拆台?美国推动俄欧“能源断交”,纯粹是利益驱动,还是在国际棋盘上谋求更大布局?美国赤字飙升、债务高企,是否会引发多重外溢?全球是否已经吹响建立新的国际金融秩序的号角? 就这些问题,观察者网采访了美国能源安全理事会高级顾问盖尔·拉夫特,探讨未来国际金融和能源体系的发展和全球权力分布的变化趋势。

【采访/观察者网 刘倩藜 翻译/宁栎】

美元自掷核弹?

观察者网:美国与欧洲盟友共同向俄罗斯投掷“金融核武器”,决定将多家俄罗斯银行从SWIFT(环球银行金融电信协会)支付系统中剔除。SWIFT系统由美国等西方国家建立,但如今对俄实施SWIFT禁令,这反而是在削弱自己建立的国际体系。这对全球经济和金融秩序会造成什么影响吗?

盖尔·拉夫特:2019年夏天,我出版了一本书《去美元化:反抗美元和新的金融世界秩序的崛起》。这本书中预测了今天发生的许多事件,但我必须说,情况变化速度之快令我非常惊讶。实际上,我们正在见证二战后由西方国家在“布雷顿森林会议”上主导建立的国际货币体系所发生的转变。在过去的几周里,美国及其盟友几次“破戒”:把一个主要经济体踢出SWIFT;未经法律程序,没收他们称之为“俄国寡头”的私人资产;最糟糕的是,他们冻结了俄央行外汇储备。

这实际上是西方在过去8个月里第二次染指别国央行储备。前一次是在去年夏天,美国冻结了阿富汗央行数十亿美元资产。在“经济战”中,冻结别国央行资产是由国家支持的海盗行为,相当于在军事冲突中使用核弹。

同时,这也是一种自我毁灭的行为,因为这将破坏其它各国央行对美元体系和基于美国规则的国际秩序的信任。美国想自己制定规则、执行规则,凡是不服从美国号令的国家都会面临和俄罗斯一样的处境。这是对许多国家敲响的一记警钟。目前,放眼全球,每十个国家当中就有一个遭受到美国某种形式的制裁。

毫无疑问,过去一个月的事件标志着全球金融史上的转折时刻,将成为经济学史上最糟糕的自毁伤口被记录。美元作为储备货币是美国在世界上的重要权力,这让美国能维持巨额赤字,维持30万亿美元的债务。

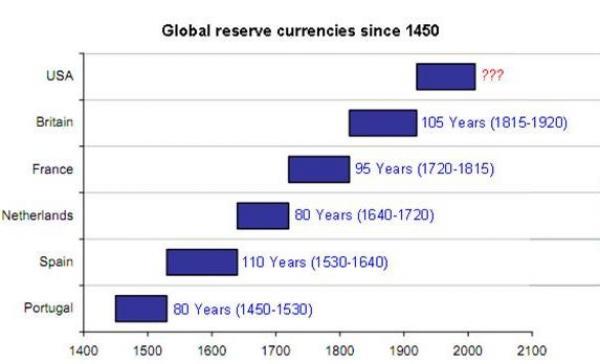

历史上有许多储备货币,平均维持了80到100年。美元作为储备货币也快到这个年限了。如果美元也重复这种历史命运,那就是因为美国政府到处发动经济制裁和惩罚,而不顾累积的负面后果。

1450年来全球储备货币(葡、西、荷、法、英、美元)的有效年限(来源:geab.eu)

观察者网:美国联邦政府债务总额超过了30万亿美元,大大超过了去年约23万亿美元的美国国内生产总值。美国势必将面临更高的债务压力。联邦政府是否可能扭转债务的持续上涨?如果不能,这会否触发更大的债务违约危机甚至是全球金融风险?

盖尔·拉夫特:如果要缩小如此巨额的债务,以下两项中至少做到一项。要不通过推动经济增长和加税来增加财政收入;要不减少开支,比如削减国防预算。理想情况下,应该采取灵活的政策组合。但目前看来,拜登政府既没有意愿也没有能力做到上述任何一项。

美国中期选举在即,且全国面临通胀压力,此时如果增税无疑是“政治性自杀”。拜登正在考虑向富人征税,但这会是一场艰难的硬仗,尤其当下已有美国资本外逃到世界各地的避税天堂。新冠疫情以来,美国开动印钞机,通过多项经济刺激计划向经济“大注水”,而美国零利率水平已维持近15年之久,美联储的“工具箱”已经耗尽。

如果减少政府开支呢?这同样不可能。事实上,随着每天有一万名“婴儿潮时期”(1946-1964年)出生的人退休,政府支出只会增加。而拜登政府2023年国防预算增加了790亿美元,仅增长部分就多过俄罗斯全国军费开支。

由于美国政府层面不愿采取任何果断行动来削减赤字,债务还将继续膨胀。随着利率不断上升,债务利息成本可能在十年后成为美国政府的第一大支出,比国防预算还大。持有美债的国家看着这种“奇观”,惊恐地问“结果会怎样?美国最终还能还清债务吗?还是说它才是所有‘债务陷阱’的始作俑者?”我认为这将影响各国央行是否继续持有美债的决策。

观察者网:据美媒近日报道,沙特阿拉伯正考虑向中国出售石油时使用人民币而不是美元结算。而据印度媒体报道,莫迪政府最近批准了俄方的一项提议,允许俄实体投资印度公司债券。在西方国家对俄进行制裁的情况下,这一机制能使印俄贸易继续进行。这些能否看作对美元和美国金融霸权的反抗?如果说,一个新的世界金融秩序正在崛起,是否为时尚早?

盖尔·拉夫特:毫无疑问,一场针对美元霸权的全面反击战正在发生。很多人会问:如果美元不再是储备货币,那么谁将取代它?欧元?人民币?但这个思路错了。这不是旧皇帝下台、新皇帝登基的逻辑。没有单一货币可以取代美元。但是,我们正从货币单极化的时代转向货币多极化的时代。

在这个时代,包括黄金和加密货币在内的多种货币将相互竞争,以期在各大央行储备中占据更大的份额。在新的金融秩序中,越来越多的国家将以非美元货币进行交易。美元对价值数万亿美元的大宗商品市场将失去掌控力,而世界对美元的需求也将下降。

一旦对美元的需求减少,美国将无法像近一个世纪以来那样轻松地出售以美元计价的债务工具。像中国这样的国家将重新考虑以之前的力度购买美债是否明智。

随着对美债的需求不断下降,美国将不得不提高其债券的利率,这意味着偿债成本将飙升,而留给国防、医疗、教育、基础设施等的资金会更少。

同时,这将影响美国提供对外援助、支持国际组织、保护其盟友以及在海外投资基础设施的能力。因此,越来越多的国家将对美国感到失望,并将寻求其它安全和经济伙伴。

在美国国内,由于用于社会服务的资金越来越少,民众会变得更加不满,这可能导致政治体系更加不稳定。

谎言帝国

观察者网:3月24日,拜登连续出席了北约峰会、七国集团峰会和欧盟峰会。面对当前俄乌冲突造成的人道主义危机和近期全球能源价格飙升,美欧仍表示将继续对俄国施压,并向乌克兰提供军事支持。看来,这次聚会不是为了 “灭火”,也不是为了和平,而是希望战争能够延长。作为美国能源安全理事会的高级顾问,您认为在能源安全和全球能源格局的角度,美国的用意是什么?

盖尔·拉夫特:当特朗普担任总统时,他创造了“美国能源主导地位”的说法,要求增加北美石油和天然气的生产,并利用这些作为外交政策的工具,取代欧佩克和俄国对美国及其盟国的影响。

拜登更倾向于环保运动,他没用这个说法,但他的意图和特朗普相似,他想把中东和俄国边缘化,因为中东不再是美国全球利益的重心。俄乌冲突是美国让欧洲受制于北美能源的一条捷径。

欧盟是一个经济上被削弱的官僚机构,由一群越来越脱离人民需求的政治精英统治。美国已经意识到在经济上接管欧洲的时机已经成熟,美国所要做的就是让欧洲与俄国能源切断联系。这就解释了美国政客们对北溪2号(译注:俄罗斯通往欧洲的新建天然气管道)的执着。

在美国参议院,拜登的所有提案一度被搁置,直到拜登提出制裁北溪2号。为什么美国对一条管道如此执着?答案是:这条管道阻碍了美国成为欧洲主要能源供应商。一旦美国接管了欧洲的能源供应,欧洲将成为美国的附庸,配合美国对付下一个目标:中国。

一旦欧洲对美国天然气形成依赖,它将付出高昂代价。比起俄国管道运来的天然气,美国液化天然气贵很多,一旦欧洲能源价格变高,欧洲的制造成本和生活成本都将受到负面影响。可悲的是,欧洲人并不能看到这一切,当他们看到时,已经太晚了。

观察者网:俄乌危机在一定程度上造成了能源价格的暴涨,欧洲天然气期货价格一度逼近3900美元/千立方米。8年前,中国和俄国签署了为期30年的天然气供应协议,价格是350美元/千立方米。目前,面对欧洲油气价格的飙升和全球通胀的压力,美国和欧洲在刚刚结束的北约峰会上宣布,将继续对俄国施加压力,并向乌克兰提供军事支持。随着战争拖长,乌克兰人民将不是欧洲唯一的受害者。对欧洲来说,美国真的是一个可靠和值得信赖的盟友吗?

盖尔·拉夫特:基辛格曾说:“美国没有永久的朋友或敌人,只有利益”。我认为这是判断美欧关系的一个好方法。许多政治家说,这种关系的基础是 “共同的价值观”,这通常是正确的,但真正使跨大西洋联盟保持完整的是共同利益。

对美国来说,一个弱小的欧洲是巨大战略机遇,使美国能够为美国公司获得许多经济利益,并建立一个经济和军事上强大的西方联盟,以后可以把它扩大到印太区域。作为这个广泛联盟的领导者,在俄罗斯被削弱的情况下,美国能把目光转向其头号战略竞争对手——中国,建立对太平洋地区的永久统治。

但从长远来看,这个联盟可能会成为美国的负担。欧洲的经济正在迅速衰退,面临沉重的债务、缓慢的经济增长、不断上升的失业率和数以百万计的难民……美国面临的潜在危险在于,如果欧洲在其内部压力下遭遇崩溃,美国将不得不投入更多的资源来维持欧洲,欧洲可能从美国“资产”变成美国“债务”。

观察者网:还记得美国举行所谓“民主峰会”前,您在中国的一场公开演讲中说:“一个多世纪以来,促进民主一直是美国外交政策的一部分”。您在推特上提到,最近美国又冒出一个新词:先进的工业民主国家,用来描述“西方+精英俱乐部”,各种Buff叠满。您生动地点评说:印度,你还不够民主;土耳其,你还不够工业化,你们必须够“先进”才能进入这个精英俱乐部。多年来,制定规则是美国自赋的特权。随着美国“选边站”的游戏不断扩大,您认为这个游戏还会有更多参与者吗?理由是什么?

盖尔·拉夫特:世界被划分为三组国家。第一组是“西方+精英俱乐部成员”,如日本、新加坡和韩国。第二组是以中国和俄国为首的所谓“修正主义国家”,这些国家希望推动建立一个更加公平的国际体系,使其他国家不再生活在西方的支配之下。第三组是大多数国家的状态:不结盟。不结盟国家从全球化体系中获益最多,它们希望在全球化体系中不受大国压力,可以自由和各国进行贸易,自由使用货币或者技术。

俄乌冲突使这三个群体之间的界限更加清晰。在近200个国家中,约有100个国家属于不结盟阵营,而其他100个国家则被夹在西方和所谓“修正主义国家”之间。这或多或少是全球权力分布的新架构。未来几年将是两个阵营之间的对抗,不结盟国家越来越多地被挤压在中间,就像一块奶酪夹在两片面包之间。

对我来说,印度是最值得关注的国家,不仅因为它正在成为人口最多的国家,还因为它也是世界上最大的民主国家,但它似乎并不想与西方结盟。印度对俄乌冲突的态度让美国震惊,美国曾以为印度是囊中之物。

最近几周的事态表明,印度不仅不想谴责和制裁俄罗斯,而且实际上已积极行动来破坏制裁,这将决定美国的印太计划能否依靠印度?印度能否成为新的不结盟运动的关键?它是否能与中国、俄国以及可能的巴西建立一个由金砖国家领导的更大的“修正主义”集团?

A bomb for itself?

Guancha: The US reached an agreement with major European allies to remove several Russian banks from the SWIFT system, in what has been called "financial nuclear bomb-level" sanctions. The SWIFT system was created by the United States, but the widening sanctions upon Russia shows that Europe and the United States are weakening the international system established by themselves. What impact will this have on the global economic and financial order?

Dr. Gal Luft:In summer of 2019 I published a book called “De-dollarization: The Revolt Against the Dollar and the Rise of a New Financial World Order.” Many of the events that are happening today were predicted in the book, but I must say that even I am quite amazed by the speed of the change. We are literally witnessing a transformation of the global financial system heralded by the western powers after the Second World War at the Bretton Woods conference. Over the past several weeks, the US and its allies have broken several taboos: They disconnected a major economy from SWIFT; they seized private assets of Russian nationals they call oligarchs without any legal proceedings, and, worst of all, they froze central bank reserves. This was actually the second time in eight months Washington laid its hands on central bank reserves. The first time was last summer when the US froze billions of dollars of the Afghan Central Bank. Freezing central bank assets in economic warfare is an act of state-sponsored piracy and the equivalent of using nuclear bomb in a military conflict. But it is also a self-defeating act which is only going to undermine the trust central bankers around the world have in the US dollar system and America’s rules-based international order. Since America wants to write the rules and enforce them, every country that does not accept Washington’s dictates could find itself in the same situation as Russia. This is a wake-up call to many countries. As it is, one in ten countries on the globe is under US sanctions. I have no doubt the events of the past month mark a watershed moment in the history of global finance, one that will go down in history as the worst self-inflicted wound in the history of economics. The dollar’s status as reserve currency is what gives America its power on the world stage, and it is what allows the US to run trillion-dollar deficits and pile $30 trillion in debt. Throughout history there have been a number of reserve currencies. The average lifespan of them has been 80-100 years. The dollar has been a reserve currency for roughly the same period of time. If it has run its course this is only because of the actions of the US government which has been trigger happy in applying sanctions and other economic punitive measures without seeing their cumulative impact.

Guancha: The total US federal government debt has exceeded 30 trillion, which has greatly exceeded the US GDP of about 23 trillion US dollars last year. We will see the interest payments on the national debt gradually rise. Is it possible for the federal government to reverse the continuing rise in debt? If not, will this trigger even stronger debt default crisis even global financial risks?

Dr. Gal Luft: In order to shrink the such a huge debt one of two things must happen: either the government increases its revenues through robust economic growth and increased taxation or the it reduces its expenditures, for example by cutting the defense budget. Ideally it would be some combination of the two. However, it does not look like the Biden administration has the power or will to do either of those. Ahead of the midterm elections and with rising inflation, raising taxes is a political suicide. Biden is talking about taxing the rich, but it would be an uphill battle with risk of capital flight from the US to various tax havens. After pouring trillions of dollars into the economy in various Covid recovery programs and after keeping interest rates at near zero for nearly a decade and a half, the Fed is running out of tools to stimulate the economy. As for reducing government expenditures this is equally unlikely. In fact, with 10,000 baby boomers retiring daily the expenditures only seem to grow. Biden’s defense budget for 2023 reflects an increase of $79 billion which is bigger than the entire military spending of Russia. With the political class unwilling to take any painful step in the direction of cutting the deficit, the debt will continue to balloon, and with rising interest rates the cost of servicing the debt could become by the end of the decade the number one expenditure of the US government – bigger than the defense budget. Countries buying US bonds watch this spectacle with horror and asking themselves “where does it all lead to?” Can the US ever pay back such debt or is it the mother of all debt-traps? I think this will shape central banks’ decisions on how much US debt to continue to hold.

Guancha: Saudi Arabia is considering using yuan instead of U.S. dollars in oil sales to China, according to recent reports from U.S. media. According to Indian media reports, the Modi government recently approved a Russian proposal to allow Russian entities to invest in Indian company bonds. In the context of financial sanctions against Russia by Western countries, this mechanism can enable India-Russia trade to continue. Could all these be regarded as a revolt against the dollar and US financial hegemony? Is it too early to say that this is the rise of a new world financial order?

Dr. Gal Luft: There is no doubt that a full-blown revolt is already taking place against the dollar hegemony. Many people are asking: if the dollar is no longer reserve currency what will replace it? The Euro? The yuan? This is the wrong framework to look at the issue. It is not the case of one king succeeding another. There is no single currency that can replace the dollar. Instead, we are moving from an era of currency unipolarity to an era of currency multi-polarity in which several currencies, including gold and cryptocurrencies, will compete against each other for greater share in central banks’ reserves. In the new financial order countries will increasingly transact with each other in non-dollar currencies. The dollar will gradually lose its grip over the multi-trillion-dollar commodity market and the demand for the US currency will fall. Once there is less demand for dollars, the US will not be able to sell its dollar denominated debt instruments with the same ease it has done for nearly a century. Countries like China will reconsider the wisdom of buying US debt in the same pace as before. With demand for its debt declining the US will have to raise interest rates on its bonds and this means that the cost of servicing its debt will spike, leaving less money for defense, health, education, infrastructure etc. This will affect US ability to provide foreign aid, support international organizations, protect its allies and invest in infrastructure projects abroad. As a result, more and more countries will become disappointed by the US and will seek alternative security and economic partners. Domestically, as less and less money directed to social services, the public will become increasingly unhappy and this could lead to an even more unstable political system.

Empire of Lies

Guancha: On March 24, Biden attended three Summits in a row, the NATO summit, G7 summit and EU summit. In the face of the humanitarian crisis caused by the current Russian-Ukrainian conflict and the recent soaring energy prices across the globe, the US and Europe still expressed that they would continue to exert pressure on Russia and provide military support to Ukraine. It seems that the get-together is not for "putting out the fire" or for peace, but wishing that the war cycle could be prolonged. As a senior advisor to the U.S. Energy Security Council, what do you think the U.S. considerations are from the perspective of energy security and the global energy landscape?

Dr. Gal Luft: When Donald Trump was president, he coined the term “American Energy Dominance” which essentially called for increased production of north American oil and gas and using these energy resources as tools of foreign policy to supplant the influence of OPEC and Russia on the America and its allies. Biden, who is much more beholden to the environmental movement, has refrained from using this term, but his intentions are similar in the sense that like Trump he wants to marginalize the Middle East, which is no longer a top priority for US global interests, as well as Russia. The war in Ukraine is a convenient way for the US to make Europe beholden to North American energy. Europe is an economically weakened bureaucratic mess ruled by a political elite increasingly divorced with the needs of its people. The US has realized Europe is ripe for economic takeover. All it has to do is to disconnect Europe from Russian energy. This explains the obsession of US politicians with Nord Stream 2 pipeline. At some point all of Biden’s nominations were put on hold in the Senate until Biden sanctions the pipeline. Why was America so obsessed about a single pipeline? The answer is that the pipeline stood in America’s way of becoming the main energy supplier to Europe. Once the US takes over European energy supply Europe will become a vassal of America in its pursuit of its next objective to take on China. Europe’s dependency on America’s gas will come at a very steep price. LNG will always be more expensive than Russian piped gas and this means that European energy prices will now become much higher with negative implications for European manufacturing and cost of living. Sadly, Europeans are not able to see any of this, and when they do, it will have been too late.

Guancha: The outbreak of the Russian-Ukrainian crisis has caused energy prices to skyrocket to some extent, and the European natural gas futures price once approached $3,900/thousand cubic meters. Eight years ago, China and Russia signed a 30-year natural gas supply agreement, which cost only $350 per 1,000 cubic meters of natural gas. At present, in the face of soaring oil and gas prices in Europe and the pressure of global inflation, the US and Europe announced at the just-concluded NATO summit that they would continue to exert pressure on Russia and provide military support to Ukraine. As the war prolongs, people in Ukraine will not be the only one in Europe to suffer. To Europe, is American really a reliable and trustworthy ally?

Dr. Gal Luft: Henry Kissinger once said that “America has no permanent friends or enemies, only interests.” I think this is a good way to judge US-European relations. Many politicians say that the relations are grounded in “shared values,” which is generally true, but what really keeps the transatlantic alliance intact are shared interests. For America, a weak Europe is huge strategic opportunity, allowing Washington to reap many economic benefits for its corporations and forge an economically and militarily powerful western alliance which it can later expand to include Indo-Pacific allies. As a leader of such a broad alliance and with a weakened Russia, the US will be able to shift it sights to its number one strategic competitor – China – and establish permanent domination over the Pacific region. But in the longer run this alliance could become a liability for America. Europe’s economy is declining rapidly, facing heavy debt, slow growth, rising unemployment, and waves of millions of refugees. The danger for the US is that if Europe collapses under its own weight the US will have to invest growing resources in keeping it afloat and Europe could turn from an asset into a liability.

Guancha: I still can recall what you said when addressing to a Chinese panel before the US's Summit of Democracy, “promotion of democracy has been a fixture of US foreign policy for more than a century”. Recently you mentioned on your Twitter account: A new term born in the blob to describe the west+ honorary members: Advanced Industrial Democracy. You put it vividly as: India, you are not democratic enough. Turkey, you are not industrial enough. You must also be “advanced” to get in the elite club. Setting-rules is a self-claimed privilege of the US for many years. Will there be more followers in the game given the widening “Us and Them” game? Why or why not?

Dr. Gal Luft:The world is divided to three groups of countries. The first group is the west plus some honorary members like Japan, Singapore and South Korea. The second are the so-called revisionists led by China and Russia, who are unapologetically pushing for a more equitable international system in which the “rest” are no longer living under the dictates of the “west.” The third group are where most of the countries are – non-aligned. Non-aligned countries stand to benefit most from the globalized system and want it to survive without being subjected to great power pressures, without being told with whom they can trade, what currency they should use or what technology they should adopt. The Ukraine war has sharpened the lines between the three groups. Out of almost 200 countries about 100 are in the non-aligned camp while the other 100 are split in half between the west and the revisionists. This is more or less the new architecture of global power. The coming years will be an epic struggle between the two camps with the non-aligned countries becoming increasingly squeezed in the middle, like a piece of cheese caught between two slices of bread. To me, India is the most interesting country to watch, not only because it is on its way to become the most populated country but because it is also the world’s largest democracy yet it does not seem to be willing to align itself with the west. India’s approach to the war in Ukraine has shocked Washington, which had assumed that the Indians are in their pocket. The events of recent weeks, with India not only unwilling to condemn Russia and join the sanctions but actually taking active steps to undermine the sanctions, will determine whether or not the US can rely on India for its Indo-Pacific ambitions, whether India becomes the linchpin of a new non-aligned movement or whether it joins China, Russia and possibly Brazil in the creation of an even bigger revisionist bloc led by BRICS.

本文系观察者网独家稿件,文章内容纯属作者个人观点,不代表平台观点,未经授权,不得转载,否则将追究法律责任。关注观察者网微信guanchacn,每日阅读趣味文章。

评论