双语阅读|博通高价收购高通,打响无情芯片之战

AT FIRST glance the chip business and the Serengeti appear to have little in common. But both are arenas where large predators hungrily stalk big game. On November 6th Broadcom announced its intention to buy its rival, Qualcomm, for around $130bn, including debt. If successful, it would be the largest deal in the history of the technology business (see table).

乍一看,芯片业务和塞伦盖蒂(Serengeti)似乎没有什么共同之处,但它们都是大型食肉动物猎食的竞技场。11月6日,博通(Broadcom)宣布将斥资约1300亿美元收购其竞争对手高通(Qualcomm),其中包括债务。如果收购成功,这将诞生科技行业史上最大的一笔并购交易(见表)。

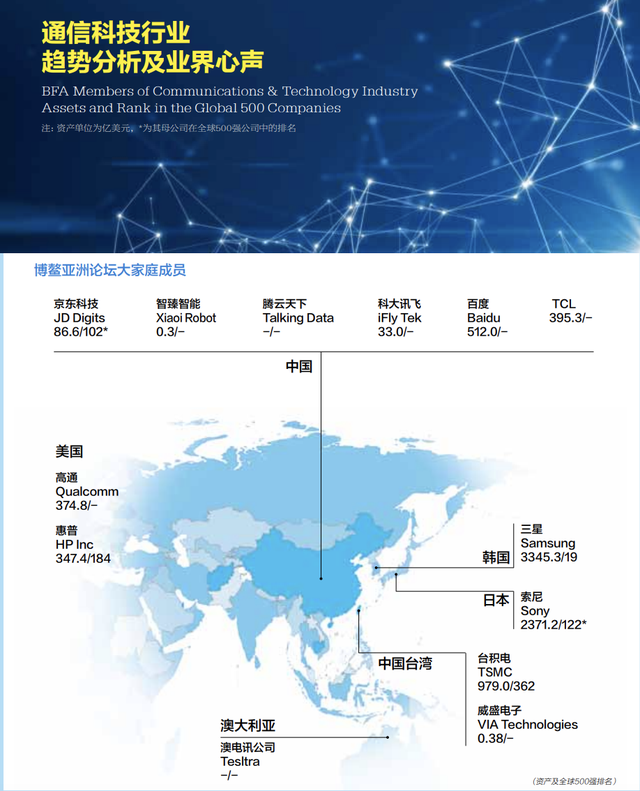

And like the African plains, the semiconductor industry supports a complex food chain with different species of chipmakers hunting each other. Qualcomm is already trying to swallow another chip firm, NXP, from the Netherlands, in a deal worth $47bn. In 2015 NXP, which makes chips for automobiles and other markets, itself completed a merger with Freescale, another large chip company. Meanwhile, Broadcom has become the world’s fifth-largest semiconductor firm by snapping up rivals. It has pulled off five big acquisitions since 2013 and is seeking approval for its $5.9bn bid for Brocade, yet another semiconductor company. If it successfully ingests Qualcomm, the combined group would become the world’s third-largest chipmaker, behind only Intel and Samsung Electronics, and a dominant supplier of many components in smartphones.

就像在非洲平原一样,半导体产业支撑着一条复杂的食物链,不同的类型的芯片制造商在相互厮杀。高通早想以470亿美元的价格吞下另一家荷兰芯片公司恩智浦(NXP)。2015年,为汽车和其他一些市场制造芯片的恩智浦自身完成对大型芯片公司飞思卡尔(Freescale)的收购。同时,博通通过快速收购竞争对手的方式成为全球第五大半导体公司。2013以来,它完成了五次大型收购,并拟以59亿美元收购半导体公司博科(Brocade)。如果成功并购高通,合并后的企业将跃升为仅次于英特尔(Intel)和三星电子(Samsung Electronics)的全球第三大芯片制造商,同时还将成为智能手机零部件的主要供应商。

Consolidation in semiconductors is only speeding up, both in memory chips and, as with this proposed transaction, in microprocessors. Between 2006 and 2016 deals worth a total of $556bn were struck as chipmakers sought to expand in a rapidly maturing industry. Previous sources of brisk growth, such as the spread of personal computers, tablets and smartphones, have dried up. Global sales of chips reached $344bn in 2016, but in the past five years they have flattened.

半导体行业的整合一直在不断加速,无论是在存储芯片上还是此次提到的微处理器交易。从2006年至2016年期间,芯片制造商寻求在一个迅速成熟的行业扩张,总价值达5560亿美元。随着如个人电脑、平板电脑和智能手机的普及,此前的快速增长来源枯竭了。在2016年,全球芯片销售额达到3440亿美元;在过去5年里,销售额增长趋于平缓。

It is against this backdrop that Hock Tan, chief executive of Broadcom, continues to hunt for new targets. His firm switched its name to Broadcom after the company he once ran, Avago, acquired it in 2015 for $37bn. This month he stood next to President Donald Trump as he announced that he would move Broadcom’s legal headquarters from Singapore to America, a move surely designed to encourage American regulators’ approval both for his acquisition of Brocade and the subsequent bid for Qualcomm.

正是在这样的背景下,博通的掌舵人谭浩克(Hock Tan)继续寻找新的目标。2015年,他曾掌管的安华高科技(Avago)以370亿美元并购博通,并更名为博通。本月,他站在唐纳德·特朗普总统旁边,宣布将把博通总部从新加坡迁回美国,此举无疑是为了让美国监管机构准许他收购博科以及随后对高通的收购计划。

Mr Tan and his firm keep a low profile and are barely known outside the semiconductor industry, but his techniques have a following. In particular, he has connections to America’s private-equity industry. Silver Lake, a prominent buy-out firm that owns a stake in Broadcom, is providing $5bn in financing for the proposed takeover, alongside banks.

谭洗克和他的公司皆行事低调,在半导体行业外鲜为人知,但他的管理技能不乏追随者。尤其是他与美国的私募股权行业的关系密切。持有博通股份的著名收购机构银湖资本(Silver Lake)将联合银行为这笔并购提供50亿美元资金支持。

Most semiconductor firms are run by electrical engineers who see engineering as the solution to their problems, says Mr Tan, who was born in Malaysia, studied engineering at the Massachusetts Institute of Technology and then business at Harvard Business School. He tackles his industry more like a private-equity boss, finding firms that are bloated and cutting costs. “He ran through Broadcom with a machete,” says Stacy Rasgon of Bernstein Research. According to Linley Gwennap of the Linley Group, a consultancy focused on semiconductors, Mr Tan eliminated an entire layer of management at Broadcom and now has around 20 business units reporting directly to him.

谭浩克表示,大多数半导体企业是由电气工程师管理的,他们把软件工程视为解决问题的方法。谭浩克出生于马来西亚,在麻省理工学院学习软件工程,随后在哈佛商学院学习商业管理。他更多地是以一个私募股权机构的老板来对待半导体行业,寻找臃肿且要削减成本的企业。伯恩斯坦(Bernstein Research)的分析师斯特西·拉斯冈(Stacy Rasgon)说:“他大刀阔斧管理着博通。” Linley Group的半导体行业分析师林利·戈文耐普(Linley Gwennap)表示,谭浩克精减了博通的整个管理层,现在大约有20个业务部门直接向他报告。

Scale helps semiconductor companies greatly because the business is so capital-intensive. Broadcom also sees benefits from Qualcomm’s investments in areas such as 5G technology, where it falls short itself. If Qualcomm’s purchase of NXP is approved, Mr Tan would also gain exposure to the automotive market and to self-driving cars, another area of promise for chipmakers.

因为半导体行业属于资金密集型行业,发展得力于规模化。博通也看到高通在5G技术等领域投资的发展前景,而博通在这个方面比较薄弱。如果高通收购恩智浦获得批准,谭浩克还将涉足汽车和自动驾驶汽车市场——这些是制造商大有作为的领域。

Qualcomm has recently suffered legal wounds, which will have helped draw Broadcom in for a kill. It makes the majority of its revenue from patent licensing, but in January America’s consumer watchdog, the Federal Trade Commission, sued it, alleging it was abusing its monopoly position in order to extract high licensing fees for baseband chips, used in smartphones. Regulatory bodies in China, South Korea and Taiwan have levied hefty fines on Qualcomm for anticompetitive behaviour. One of the semiconductor industry’s most powerful customers, Apple, has also sued Qualcomm over its licensing terms, and iPhone manufacturers have started withholding royalty payments, depriving Qualcomm of billions in sales as the dispute rages on. There is no end in sight.

高通最近陷入了法律纠纷,无疑助力了博通的一举将它拿下。高通的大部分收入来自专利许可,但在一月,美国消费者监督机构——联邦贸易委员会(Federal Trade Commission)对其提出诉讼,声称它滥用自己的垄断地位,以便收取用于智能手机的基带芯片的高额许可费。中国、韩国和台湾的监管机构都对高通的反竞争行为开出了巨额罚单。作为半导体行业最具影响力的客户之一,苹果公司(Apple)也起诉高通的许可条款,iPhone制造商已经开始拒绝支付版税。这使得高通在争议不断的时候失去了数十亿美元的销售收入。这样的境况不知何时能结束。

Mr Tan has suggested that new ownership could lead to a more amicable relationship between Qualcomm and customers such as Apple, although there is little evidence for that view. In a few areas, including connectivity chips that enable Wi-Fi and radio-frequency chips, Broadcom and Qualcomm compete; having a giant firm with more market power is not likely to please chip buyers. If they combined, with no divestments, Qualcomm and Broadcom would control between 50%-60% of the market for Wi-Fi chips and 27% of radio-frequency chips for mobile devices. According to Mr Gwennap, Broadcom has raised prices in some markets where it has a dominant share, such as Ethernet switches for data centres, and customers are unhappy.

谭浩克表示,新东家能间高通和苹果等客户之间建立更友好的关系,不过现在没有任何证据能证明这个观点。在一些领域,包括支持wi-fi和射频芯片的连通性芯片,博通和高通之间存在竞争;对拥有市场更多的大公司不太可能取悦芯片购买者。如果两家合并且没有撤资,高通和博通将控制50% - 60%的wifi芯片市场的和27%用于移动设备的射频芯片市场。按照戈文奈普的说法,博通在一些占主导地位的市场提价,如数据中心以太网交换机,惹得客户很不满意。

Chip, chip, chip, chip hooray

芯片,芯片,芯片,芯片万岁

Qualcomm’s board is said to be preparing to reject the offer, which it considers to be too low. Broadcom could raise its price to see through a deal, or pursue a hostile bid. But even if Broadcom wins the support of Qualcomm’s bosses and shareholders, there are large risks, says Geoff Blaber of CCS Insight, a research group. With Qualcomm’s pending purchase of NXP and Broadcom’s of Brocade, what looks at first glance like a merger between two giants is actually a four-sided deal. It would be difficult to unite so many different divisions and business units all at once.

据说高通董事会认为报价太低,准备拒绝这一提议。博通可能提高价格以达成交易,或开展恶意收购。英国的研究团体CCS Insight的杰夫·布雷伯(Geoff Blaber)表示,即使博通赢得高通老板和股东的支持,依然存在很大的风险。高通即将收购恩智浦,博通也将收购博科,乍看上去这是两大巨头的合并,但实际是一场四方交易。短期内统一这么多不同的部门和业务单位并非易事。

A second risk is regulatory. The European Commission’s ongoing investigation of Qualcomm’s proposed acquisition of NXP is suggestive of the close scrutiny that another mega-deal in chips could receive in Europe, says Thomas Vinje, head of antitrust at Clifford Chance, a law firm, in Brussels. China’s antitrust regulators could also prove difficult. They may want to protect their own, home-grown chipmakers.

第二个风险是监管。布鲁塞尔的高伟绅律师事务所(Clifford Chance)的反垄断主管托马斯•维耶(Thomas Vinje)表示,欧盟委员会正在对高通拟议收购恩智浦的交易进行调查,这暗示着另一起超大规模芯片交易可能会在欧洲接受严密的审查。中国的反垄断监管机构应对起来同样不容易,因为他们会想保护自己本土芯片制造商。

Some have interpreted the bid as an attempt by Broadcom to enter future fast-growing areas, such as chips for connected devices, collectively called the “internet of things”, and artificial intelligence, where Nvidia, another chipmaker, dominates. But the combined entity may actually be too focused on maturing semiconductor markets; by swallowing Qualcomm, Broadcom would be doubling down on smartphones rather than diversifying away from them.

一些人认为博通的收购意在进入未来快速增长的领域,比如连接那些统称为“物联网”设备的芯片,以及被另一家芯片制造商英伟达(NVIDIA)主导的人工智能芯片。合并后的实体实际上可能过于专注于成熟的半导体市场;吞并高通,博通将在智能手机领域销量翻番,而不是开拓出其他各类市场。

Yet Mr Tan sees this as a good thing. “Focus is the key to success as the industry consolidates,” he says. “We try to progress innovation in areas we are already good at.” Perhaps he thinks that he can buy into new categories in the chip business when he is ready to roll them into his giant company. Skilled hunters learn never to reveal where they might be planning to attack next.

然而,谭浩克认为这是一件好事。“在行业整合的过程中,专注是成功的关键。”他说,“我们努力在擅长的领域进步创新。“也许他认为,当他做好准备把芯片业务发展成巨型公司时,他就能买下芯片业务里的新门类市场。高超的猎人永远都不会透露他们下一个计划攻击目标。

编译:邓思琦

审校:程馨莹

编辑:翻吧君

来源:经济学人

阅读·经济学人

全球房地产市场努力适应电子商务

荷兰ING银行的网络银行战略

创新科技能给非洲的发展带来什么?

![]()

翻吧·与你一起学翻译

微信号:translationtips

长按识别二维码关注翻吧

评论