新加坡预扣税 (Withholding Tax of Singapore)

出海新加坡运营实体公司或者是离岸贸易,经常需要支付国际合作伙伴的费用,那么就涉及到一个很重要的法规-预扣税。麒麟咨询根据2020年最新税务规定,整理了一个全面精简的预扣税介绍,给大家参考。

Entrepreneurs expanding overseas often set up companies in Singapore as their regional HQ or just a shell to conduct offshore trading. The companies usually need to make payments to international parties, and this is where withholding tax comes in. Kirin Consultancy has done a thorough search on the lasted Income Tax Act as of June 2020, and concluded this most FAQs with answers for your kind reference.

根据新加坡所得税法(Income Tax Act)的规定,支付给非税务居民的款项,支付该款项的公司需要从中预扣一定比例税款并在一定时限内缴纳给税务局。 新加坡税务局的上级部门是新加坡财政部。

As per The Income Tax Act of Singapore, payments made to Non-resident companies / individual are subject to Withholding tax. The tax rate depends on the nature of the income and is payable within a time limit. IRAS reports to Ministry of Finance.

谁需要“预扣”税款?

Who Must Withhold Tax

根据新加坡法律,新加坡公司向非居民公司或个人(称为收款人)支付指定性质(例如,特许权使用费,利息,技术服务费等)的款项(称为付款人) 必须预扣一定比例的付款,并将预扣金额(称为“预扣税”)支付给新加坡税务局。

Under Singapore law, a person (known as the Payer) who makes payment(s) of a specified nature (e.g. Royalty, Interest, Technical Service Fee, etc.) to a non-resident company or individual (known as Payee) is required to withhold a percentage of that payment and pay the amount withheld (called 'Withholding Tax') to IRAS.

哪些支付给非税务居民的个人/公司需要预扣税款?

What Are The Payments to a Non-Resident that Require You to Withhold Tax

· 服务费,利息,特许权使用费,动产租金等

· 付给非居民董事/专业人士/公共演艺人员和国际市场代理商的费用

· 退出补充退休计划(SRS)账户的外国人/永久居民

· 房地产投资信托(REIT)的分配

· Payments for Services, Interest, Royalty, Rental of Movable Properties, etc.

· Payments to Non-Resident Directors, Professionals, Public Entertainers & International Market Agents

· Foreigners/PRs Withdrawing from Supplementary Retirement Scheme (SRS) Account

· Distribution of Real Estate Investment Trust (REITs)

如何界定“非税务居民”公司或个人

Who Are Non-Resident Companies or Individuals

付款人为了确定是否适用预扣税,付款人必须确定付款是向在新加坡非税务居民的公司或个人付款的。

To determine whether withholding tax is applicable, the Payer has to ascertain that the payment was made to a company or an individual who is Non-Resident in Singapore.

1. 非税务居民公司 (Non-Resident Company)

在新加坡,公司的税务居民地位由控制和管理业务的地点确定。

“控制和管理”是对战略事务(例如公司政策和战略)的决策。 公司的控制和管理权在哪里行使是一个事实问题。 通常,公司董事会会议的地点(在此期间制定战略决策)是确定在何处执行控制和管理的关键因素。

相反,如果在新加坡未对公司进行控制和管理,则该公司为非居民。

请注意,公司的注册地不一定表示公司的税收居住地。但是如果需要,麒麟会给客户提供申请新加坡税务居民证的服务。

A company is either a tax resident or a non-resident of Singapore. In Singapore, the tax residency of a company is determined by the place in which the business is controlled and managed.

“Control and management” is the making of decisions on strategic matters, such as those on company policy and strategy. Where the control and management of a company is exercised is a question of fact. Typically, the location of the company’s Board of Directors meetings, during which strategic decisions are made, is a key factor in determining where the control and management is exercised.

Conversely, a company is a non-resident when the control and management of the company is not exercised in Singapore.

Do note that the place of incorporation of a company is not necessarily indicative of the tax residence of a company. However Kirin can apply for Certificate of Residence for the clients if needed.

2. 非税务居民个人(Non-Resident Individuals)

a. 外国专业人士(非税务居民专业人士) Foreign Professional (Non-Resident Professional)

外国专业人士是根据服务合同从事独立性质的任何职业(除签订劳动合同的雇员以外的人员)的个人。比如:律师,顾问,医生等。

Foreign professionals are individuals exercising any profession (i.e. persons other than employees) of an independent nature under a contract for service.

b. 外国艺人 (非税务居民艺人)(Non-Resident Public Entertainer)

在新加坡做商演的公众演艺人员,比如:演员,歌手,运动员等。

艺人纳税收入包括片酬/演出费/津贴/实物福利等;运动员纳税收入包括参赛费/奖金/津贴/实物福利/超过$100元的奖品等。

不计入艺人纳税收入的有机票/一年里不超过60天的住宿/不超过$100的奖品等。如果收入已经包含了机票住宿等,那么该费用可从税前收入扣除。

如果艺人以新加坡注册的公司的方式参加商演,并且演出合同以新加坡公司签订,收入归入公司,则该艺人不需要支付非居民预扣税。更多可以咨询麒麟的税务专员。

A public entertainer performing in Singapore can be exercising a profession, vocation or employment.

For artistes, gross income refers to both cash and non-cash payments and includes, but not limited to artiste fees, allowances and benefits-in-kind. For sportsmen, gross income refers to match fees, prize money, tournament winnings, win bonuses, allowances, benefits-in-kind and non-cash gifts exceeding $100.

Not-Taxable Income include accommodation (excluding value of food) for short-term engagement of 60 days or less in any calendar year and cost of airfare. If those are included in the income, the costs are tax deductible.

However, if the public entertainers conduct the business via their registered company in Singapore, and the business contracts signed via the company and the companies receive the income, then the income is not subject to withholding tax. For more information, please seek advice from Kirin tax experts.

c. 外国董事 (非税务居民董事)Foreign Board Director (Non-Resident Director)

在新加坡本地公司担任董事职位的外国人。如果该董事一个自然年里在新加坡居住的时间少于183天,则被界定为非居民董事。但是,如果该董事为公司的执行董事(例如总裁或董事经理),因管理日常运营而在新加坡居住时间少于183天,该执行董事在新加坡公司取得的董事金不需要缴纳预扣税。

For tax purposes, a board director is a member of the board of directors of a company. If the director stays less than 183 days in a calendar year, he/she will be defined as a non-resident director and withholding tax applies. However, a board director may also take on an executive role (for example, Chief Executive Officer, Chairman and Managing Director) and is involved in the daily running of the business operations. The remuneration derived by a non-resident director in his capacity as an executive director is not subject to withholding tax.

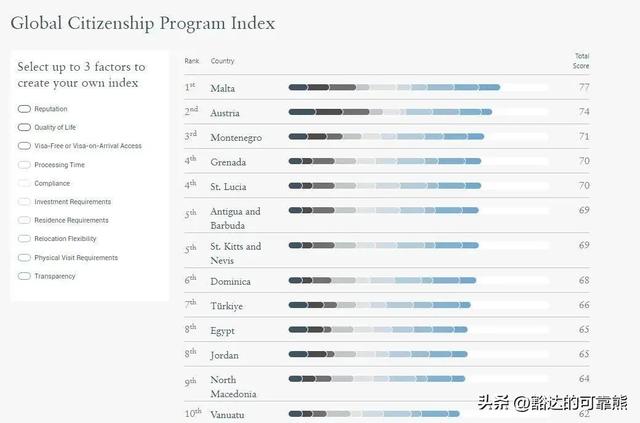

您应该预扣多少税?

How Much Tax You Should Withhold

根据付款的性质,预扣税率会有所不同。 有关预扣税率的更多详细信息,您可以参考以下麒麟小编整理的最全付款类型和适用的预扣税率表。

Depending on the nature of payment, the withholding tax rate will vary. For more details on the withholding tax rates, you may refer to the table below.

何时以及如何向税务局代扣代缴税款?

When and How to File and Pay the Tax Withheld to IRAS

付款人必须在向非居民付款之日起的第二个月的15日之前,向税务局进行电子申报并缴纳预扣税。

例如:2020年6月18日,环球智慧有限公司按合同规定需要向任职的外国董事A支付2020年第二季度董事金2万新元。那么按照法规,公司需要扣除22%的预扣税,在2020年7月15日前向税务局申报并缴纳该笔4400新元税费,董事A实际领取董事金为($20,000 – $4,400)= $15,600 。

The Payer must e-file and pay the withholding tax to IRAS by the 15th of the second month from the date of payment to the non-resident.

For example, on 18th Jun 2020, Universal Wisdom Pte. Ltd. needs to pay its foreign board director Mr. A a director fee of $20,000 as per contract. As per the Income Tax Act, company has to deduct 22% of withholding tax ($4,400) and report to IRAS before 15th Jul 2020. The net amount that director A receives will be only $15,400.

哪些收入不需要缴纳预扣税呢?

What income are not applicable to withholding tax

新加坡公司支付给外国个人或者机构的股息分红不需要缴纳预扣税。例如,马先生在新加坡注册了ABC有限公司,公司2020年年底支付给股东马先生100万美元分红,该笔收入不需要支付任何税费。

The dividend paid from a Singapore registered company to a non-resident foreigner or organization is free from withholding tax. For example, Mr. Ma is the shareholder of ABC company registered in Singapore, the company distributes $1,000,000 dividend to Mr. Ma at the end of year 2020, this dividend is totally tax free.

为什么要纳税?

Why we need to pay tax

从企业主的角度,我们来问一个灵魂拷问的问题,为什么要纳税?对企业主来说,纳税的意义在哪里?麒麟咨询要告诉企业主的是,你们赚取的利润需要一个主权政府去背书,去认证这是合法收入,去保护你的合法收入不被侵犯。隐瞒收入偷税漏税导致没有主权政府替你背书,那么公司股东的祖国有权调查/罚没收入,利润取得国家有权调查罚没/收入,公司的商业伙伴的所在国有权调查/罚没收入,风险极大。

评论