哥大教授魏尚进:特朗普对TikTok动作损人不利己

作者:魏尚进 复旦金融评论(ID:FFReview)

美国总统唐纳德·特朗普(Donald Trump)发誓要在美国封禁抖音海外版TikTok之后,这款广受欢迎的短视频应用的中国母公司字节跳动就一直忙不迭地与微软进行谈判,试图在禁令生效之前迅速出售其子公司。

特朗普的真实意图可能不是封禁TikTok,而是将其贱卖给美国买家。特朗普曾表示,他希望收购方是“非常正宗的美国公司”,甚至称收购方应向美国政府支付中介费用,以回报其通过威胁压低交易价格。

尽管特朗普的种种举动可能会让美国收获短期利益

,但它们其实也给美国利益带来了严重的潜在风险,更不用说对国际和国内的商业规则构成负面影响。毕竟,如果一国政府可以随意勒索民营企业,那么对商业信心会产生怎样的打击?

字节跳动由时年29岁的张一鸣于2012年创立。这是一个(美国文化应该喜欢的)白手起家、草根成功的故事,就像是脸书的马克·扎克伯格(Mark Zuckerberg),特斯拉的埃隆·马斯克(Elon Musk),亚马逊的杰夫·贝佐斯(Jeff Bezos)和苹果联合创始人史蒂夫·乔布斯(Steve Jobs)的创业故事。身为客家人的张一鸣是一位创业“惯犯”,曾参与创建了另外几家互联网公司,屡创屡胜,其中包括在线房地产搜索和交易平台九九房。

字节跳动在中国拥有许多广受欢迎的数字产品,包括与谷歌新闻类似的中文新闻聚合应用今日头条。但它在美国、印度和其他140多个国家最著名的产品还是TikTok(抖音海外版)。它可以让用户快速、轻松地创建、编辑和发布短视频。这款应用风靡全球(甚至令人上瘾),尤其在年轻人中拥趸众多。它是2018年和2019年全球下载量最大的社交媒体应用程序之一,并且被用于教育领域。有许多趣味教英语或介绍美国文化的节目发布于此平台。《复旦金融评论》支持的线上课程“复旦金融公开课”,也用其抖音号作为课程播放的平台之一。

凭借高效的视频推荐算法并允许用户打赏内容创建者,这款应用程序在很短的时间内就催生了一批新的数字创业者。现在,来自众多国家中的许多人以创造TikTok小喜剧、舞蹈、语言教程和时尚小贴士为生。短短的时间,TikTok已成为中国的微信以及美国和其他地区的YouTube和Facebook的竞争对手。

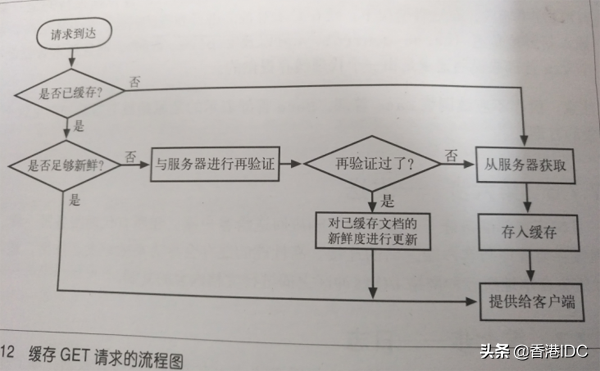

字节跳动意识到美国对中国数字产品的敏感性,因此采取了若干步骤尽量将TikTok设置为相对独立的实体。比如字节跳动将所有美国用户数据存储在位于美国的服务器上(同时在新加坡有备份副本),还聘请了迪士尼前高管凯文·梅耶尔(Kevin Mayer)担任首席执行官。但特朗普政府认为这些措施是不够的,声称美国用户数据已经或将被发送给中国政府。但美国尚未提供任何证据。

TikTok现任CEO凯文·梅耶尔(Kevin Mayer)

变相强迫TikTok贱卖给“非常正宗的美国企业”的做法,实际上会危害众多在中国市场上的美国公司。在中国投资与运营的美国公司数量远多于在美国运营的中国公司。仅2019年,美国在华新投资总额就达到140亿美元,比2018年增加了10亿美元;而中国在美国当年的投资仅为60亿美元。到2018年为止,美国在华累计投资已增至约2,690亿美元,几乎是中国对美投资1,450亿美元的两倍。

此外,通用汽车、通用电气、杜邦、默克、辉瑞、礼来、百时美施贵宝、波音、耐克、可口可乐、宝洁等美国制造业巨头,以及高盛、摩根士丹利、微软、星巴克、肯德基和麦当劳等大型服务公司,都经营着相当规模的中国业务。它们在中国的业务极其重要,有些可以占公司全球利润的30%左右。

如果中国效仿特朗普的伎俩——在没有证据的情况下,就声称某些美国跨国公司对国家安全构成潜在威胁——就可以迫使这些公司将业务出售给“非常正宗的中国公司”。尽管中国政府尚未这样做,但这样的风险(因为特朗普的做法)已经有所增加。

第二个对美国的打击是进一步丧失许多中国人对美国其他要求的支持。当美国历届政府对民权、法治、知识产权、信息通畅和环境保护等提出要求时,许多中国企业家、学者和其他人士可能对这些目标感到认同。许多中国人愿意向美国学习,在中国推动相关的改革。

欢迎关注徐瑾视频号,一分钟带你学财经

但是,当美国攻击字节跳动和其他中国民营企业时,在中国引起的是截然不同的反应。特朗普的举动看上去就是对中国企业家与成功企业的攻击,这会对中国市场化的经济改革带来非常负面的影响。当所谓国际规则的鼓吹者是按照强盗法则行事时,谁还会在乎它所鼓吹的国际规则呢?

如果美国确实对隐私或国家安全有担忧,那么它处理TikTok完全可以换一种方式方法。例如,美国政府本可以提前告知字节跳动,在美国存储美国用户数据还不足以合规,然后让字节跳动有足够的、合理的时间,在公开市场上出售美国业务,而不是被强迫移交给“非常正宗的美国公司”。在公平交易的环境里,至少来自英国、澳大利亚、加拿大、法国、新加坡或日本等国的收购方也会得到与美国企业同样的认可。为了维护商业规则与投资环境的声誉,所有企业都应得到公平对待,字节跳动也理应享有获得公平交易价格的权力。

这样的方案可以避免掠夺性的交易——以及避免由此给美国企业与国际商业规范带来的风险。而现在特朗普实质上是在做美国长期以来一直指控中国做的事情:不尊重私有财产,无证据先验定罪,侵蚀外国公司的合法权利,并使用随意而不透明的规则干扰外资企业在本国的正常经营。

因为TikTok交易还在发酵,特朗普政府还有时间改弦更张。希望那些破坏规则、损人而不利己的政策少一点冲上今日头条。

The US May Lose in Trump’s TikTok War

SHANG-JIN WEI

Following US President Donald Trump’s vow to block US access to TikTok, the popular short-video app’s Chinese parent company, ByteDance, has been in frantic talks with Microsoft, presumably to sell its subsidiary quickly before the ban goes into effect.

Of course, it is possible – even likely – that Trump’s real intent is not so much to ban TikTok as to force a fire sale to a US buyer. Trump has said that he wants the buyer to be “very American,” and has even mused that the acquiring company should pay the US government a fee for driving the price down with its threatened ban.

Although Trump’s actions could yield a short-term gain for the US, they have introduced severe potential risks to US interests, not to mention to international and domestic rules of commerce. After all, what would happen to business confidence if governments assumed that they could extort private enterprises at will?

ByteDance was founded in 2012 by ZhangYiming, 29 years old at the time and a self-made success story in the mold of Facebook’s Mark Zuckerberg, Tesla’s Elon Musk, Amazon’s Jeff Bezos, and the late Apple co-founder Steve Jobs. An ethnic Hakka, Zhang is a serial entrepreneur who has had a hand in founding several other Internet companies, including 99fang.com, an online real-estate search and transaction platform.

ByteDance has a number of popular digital products in China, including the Chinese-language news aggregator Toutiao, which is similar to Google News. But its best-known product in the United States, India, and more than 140 other countries is TikTok, which allows users to create, edit, and post short videos quickly and easily. The app is extremely popular (some might say addictive), especially among young people. It was one of the world’s most downloaded social-media apps in both 2018 and 2019, and it has also been adopted for educational purposes. In both China and India, it is host to popular tutorial programs to teach English and American culture.

With an efficient video-recommendation algorithm and a feature that allows users to tip content creators, the app has given rise to a new class of self-employeddigital entrepreneurs within a very short period of time. Many people now earn a living creating TikTokcomedies, dances, language tutorials, and fashion tips. In short order, TikTok has emerged as a rival to WeChat in China, and to YouTube and Facebook in the US and elsewhere.

Anticipating US sensitivities about a Chinese digital product, ByteDance has taken several steps to make TikTok a separate entity. Among other things, it stores all US user data on US-based servers – albeit with a backup copy in Singapore – and it has hired Kevin Mayer, a former Disney executive, as its CEO. The Trump administration regards these measures as insufficient, arguing that US user data are being or will be sent to the Chinese government. But the US has yet to present any evidence for this claim.

Forcing TikTok to be sold cheaply to a“very American” buyer will endanger many US firms in the Chinese market. More US companies operate in China than vice versa. In 2019 alone, new US investment in China totaled $ 14 billion, an increase of $1 billion from 2018, compared to$6 billion in Chinese investment in the US. By 2018, cumulative US investment in China had grown to about $269 billion, almost twice the $145 billion in Chinese investments in the US.

Moreover, US manufacturing giants such as General Motors, General Electric, DuPont, Merck, Pfizer, Eli Lilly, Bristol Myers Squibb, Boeing, Nike, Coco Cola, Proctor & Gamble, and major service firms such as Goldman Sachs, Morgan Stanley, Microsoft, Starbucks, KFC, and MacDonald’s all maintain sizable China operations. Their business in China may account for as much as 30% of their global profits.

If China were to mimic Trump’s gambit – alleging, without providing evidence, that some US multinationals are potential national-security threats – it could force them to sell their operations to “very Chinese” buyers. Although the Chinese government has not yet done so, the risk has become higher now.

A second major risk is that the US could lose support for other causes within China. When successive US administrations make demands with respect to human rights, the rule of law, intellectual-property rights, information flow, and climate change, plenty of Chinese entrepreneurs, academics, and others would echo the sentiment. Many Chinese are eager to learn from Americans, so that they can advance these objectives in China.

But when the US attacks TikTok and other Chinese private-sector firms, it elicits a very different reaction in China. Trump’sactions look like an assault on Chinese entrepreneurship itself, and will weaken the position of those in China who advocate a more market-oriented economic model. Why bother with international norms when the supposed exponent of rule-based governance operates by the law of the jungle?

If the US did have legitimate concerns about TikTok posing a threat to privacy or national security, it could have handled matters very differently. For example, the US government could have notified ByteDancethat storing US user data in the US was not sufficient, and then provided sufficient lead time for the company’s owner to sell the US operation in an open market, rather than forcing a handoff to a “very American” buyer. A British, Australian, Canadian, French, Singaporean, or Japanese firm should be considered equally acceptable. And for the sake of all future business, the company deserves a chance to receive a fair price.

This alternative approach would have avoided a blatant expropriation – and the attendant risks – that now seems likely. Trump is essentially doing what the US has long accused China of doing: disrespecting private property, presuming guilt without evidence, eroding foreign firms’ legitimate rights without compensation, and using arbitrary, opaque rules to block them from operating in the country.

There is still time for the Trump administration to change course and avoid damaging US interests. But the clock is running – ticktock.

* 作者魏尚进现任复旦大学泛海国际金融学院学术访问教授、哥伦比亚大学终身讲席教授。同时担任美国国民经济研究局(NBER)中国经济研究组创始主任,美国布鲁金斯学会(Brookings Institution)高级研究员。曾任亚洲开发银行(ADB)首位华人首席经济学家、经济研究与区域合作局局长,国际货币基金组织(IMF)贸易与投资处处长,世界银行(WB)顾问等职务。

* 本文英文原文发表于《报业辛迪加》(Aug 6, 2020, Project Syndicate)。翻译:吴畏,编辑:潘琦。

50本好书,两季一起学

50本好书,两季一起学

50本好书,两季一起学

评论