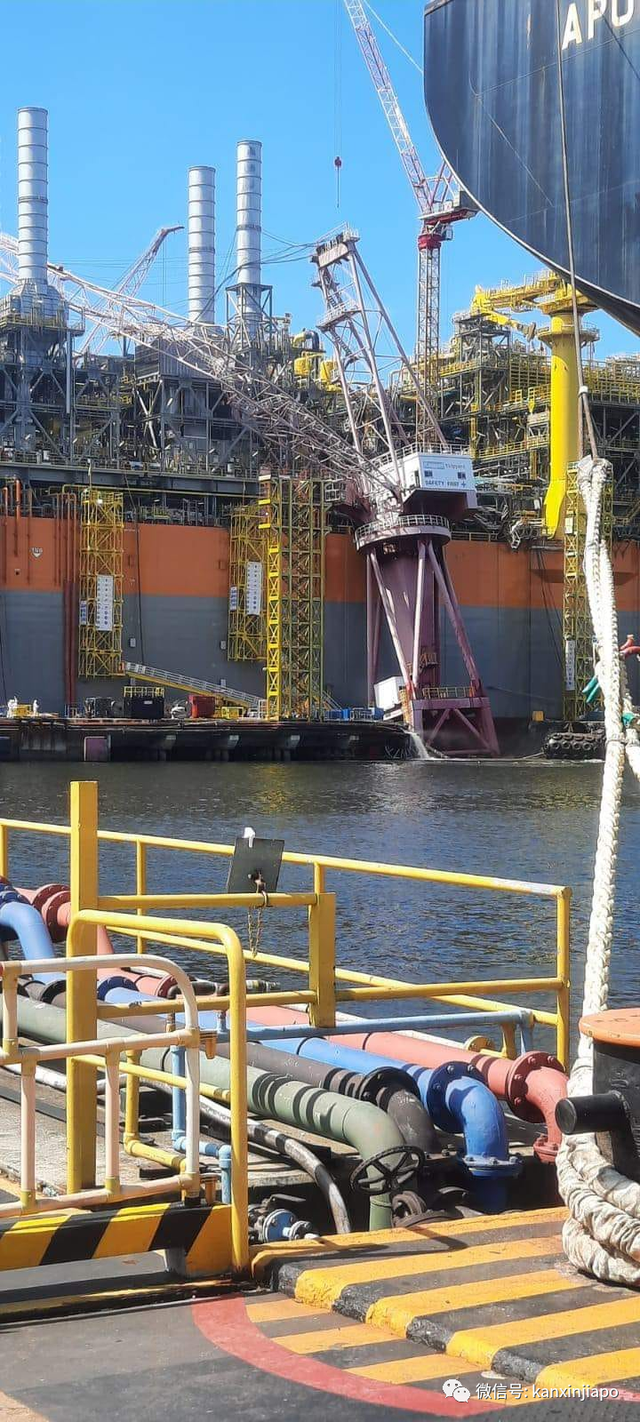

新加坡财富基金将投资ADNOC50亿美元的管道项目,占股6%

迪拜-新加坡主权财富基金GIC加入阿布扎比国家石油公司(Abu Dhabi National Oil Co.)50亿美元的管道项目,该项目已经吸引了贝莱德公司(Blackrock Inc.)和KKR&Co。该项目是投资机构与中东国家石油公司之间的第一个中游合作项目。

Adnoc周二在一份声明中称,管理着1000多亿美元资产的GIC在管道项目上投资6亿美元,并持有新成立的Adnoc石油管道6%的股份。

贝莱德和KKR已经共同持有40%的股份,ADNOC 51%和阿布扎比退休养老金和福利基金3%。ADNOC表示,新基金将使以租赁为基础的组合投资达到49亿美元。

阿布扎比国家石油公司说:“对管道的主权和对管道运行的管理权仍然属于ADNOC。”交易预计将在2019年底前完成,但须满足符合惯例的成交条件和获得所有监管机构的批准。

ADNOC,是阿联酋的经济驱动机?据估计阿布扎比日产原油为300万桶,正在向国际石油公司授予合同使其获得油田特许权,并签订协议将其资产货币化。阿布扎比希望到2020年将产量提高到400万桶/日,到2030年将产量提高到500万桶/日。

“总投资近50亿美元,总体协议证明了全球投资界对阿联酋长期潜力和ADNOC有极大的吸引力和保持积极的看法“。ADNOC集团财务和投资总监艾哈迈德·扎阿比(Ahmed al-Zaabi)表示。

ADNOC在2月份表示,ADNOC输油管道将出租该国石油公司在18条输油管道上的权益,并授予从该公司运输原油和凝析油的权利。在陆上和海上的特殊经营权超过23年。

“作为一名全球长期投资者,我们对ADNOC庞大的石油管道网络的质量充满信心,这是阿布扎比能源生态系统的核心要素,”GIC基础设施投资总监Ang Eng Seng说。

Singapore wealth fund to invest in ADNOC's $5 bil pipeline deal

Dubai — Singapore sovereign wealth fund GIC joined state-run Abu Dhabi National Oil Co.'s $5 billion pipeline deal, which has already attracted BlackRock Inc. and KKR & Co in what is the first midstream partnership between institutional investors and a Middle East national oil company.

GIC, which manages over $100 billion in assets, will invest $600 million in select pipeline infrastructure and hold a 6% stake in newly-formed ADNOC Oil Pipelines, ADNOC said in a statement on Tuesday.

Already BlackRock and KKR together hold a 40% stake, ADNOC 51% and Abu Dhabi Retirement Pensions and Benefits Fund 3%.The new funds will bring combined lease-based investment to $4.9 billion, ADNOC said.

"Sovereignty over the pipelines and management of pipeline operations remain with ADNOC," the national oil company said. The transaction is expected to close before the end of 2019, subject to customary closing conditions and all regulatory approvals, it said.

ADNOC, which pumps most of the UAE?s estimated 3 million b/d, is awarding contracts to international oil companies, offering up oil and gas fields to concession and striking deals to monetize its assets. It also wants to boost its output to 4 million b/d by 2020 and 5 million b/d by 2030.

"With nearly $5 billion of total investment, the overall agreement is testimony to the global investment community's positive view on the attractiveness of both the UAE's long-term potential, as well as the quality of ADNOC?s substantial infrastructure asset base," said Ahmed al-Zaabi, group director finance and investment at ADNOC.

ADNOC said in February ADNOC Oil Pipelines will lease the national oil company's interest in 18 pipelines and give rights to transport crude and condensates from the company?s onshore and offshore concessions over 23 years.

"As a global long-term investor, we are confident in the quality of ADNOC's substantial oil pipeline network, which is a core element of Abu Dhabi's energy ecosystem," said Ang Eng Seng, chief investment officer for infrastructure at GIC.

评论