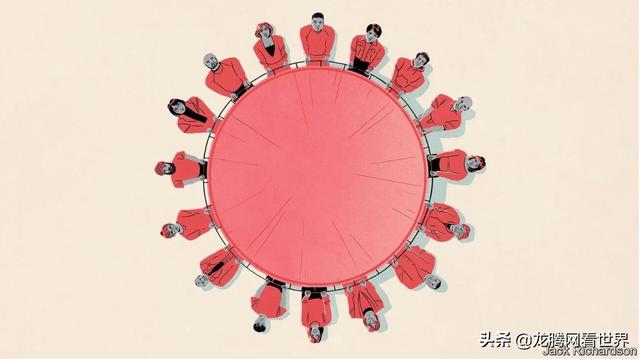

「龙腾网」21世纪的福利:如何构建后新冠时代的社会保障体系

正文翻译

Welfare in the 21st century

21世纪的福利

How to make a social safety-net for the post-covid world

如何构建后新冠时代的社会保障体系

Governments must remake the social contract for the 21st century

政府必须为21世纪重新缔结社会契约

After the Depression and the second world war, voters and governments in rich countries recast the relationship between the state and its citizens. Now the pandemic has seen the old rules on social spending ripped up. More than three-quarters of Americans support President Joe Biden’s $1.9trn stimulus bill, which is due in the Senate and includes $1,400 cheques for most adults. And in the budget on March 3rd Britain extended a scheme to pay the wages of furloughed workers until September, even as public debt hit its highest level since 1945 (see article). Such boldness brings dangers: governments could stretch the public finances to breaking-point, distort incentives and create sclerotic societies. But they also have a chance to create new social-welfare policies that are affordable and which help workers thrive in an economy facing technological disruption. They must seize it.

在经济大萧条和二战结束后,发达国家的选民和政府重塑了国家与公民的关系。现在社会支出的旧规则在大流行中失效。四分之三以上的美国人支持乔·拜登总统即将在参议院提交的1.9万亿美元经济刺激法案,包括为大多数成年人发放1400美元支票。英国在3月3日提交的财政预算案中,为待业工人发放薪水的计划被延期至9月份,同时公共债务已达到1945年以来的最高水平。这种勇敢带来了风险:政府可能使公共财政达到临界点,扭曲激励机制,形成僵化社会。但也可能开创新的社会福利政策,不仅负担得起,而且帮助工人在被技术颠覆的经济中取得成功,他们必须抓住这个机会。

With the public and some economists cheering on, it is tempting for politicians to stoke the economy with more ad hoc spending, or put in place vast schemes such as ubi. Instead they need to take a measured, long-term view. The safety-net must be affordable. Tight budgets, not milk and honey, will define the 2020s. The annual deficit of big advanced economies was 4% of their combined gdp even before the pandemic—and much ageing is still to come. Already bond yields are rising again (see article). Social spending must flow quickly and automatically to those who need it—not, as in America, only during crises when a panicked government passes emergency legislation. And governments need to find mechanisms that cushion people more effectively against income shocks and joblessness without discouraging work or crushing economic dynamism.

在公众和一些经济学家的鼓动下,政客倾向于用临时性支出刺激经济,或者出台全民基本收入这样的庞大计划。相反,他们需要审慎长远的眼光,社会保障体系必须量力而行。20世纪20年代将是预算吃紧而非宽裕的时代。即使在大流行爆发之前,主要发达国家的年度赤字已达到它们GDP总和的4%——并且人口老龄化仍在继续。债券收益率再次攀升。社会支出必须快速自动流向有需要的人——例如美国,惊慌失措的政府不能只在危机期间出台紧急法案。政府需要这样一种机制:既能有效地缓解民众受到收入和失业的冲击,又不让他们丧失工作的信心或破坏经济活力。

The first step towards satisfying these goals is to use technology to make ancient bureaucracies more efficient. Postal cheques, 1980s mainfrx computers and shoddy data need to be relegated to the past. In the pandemic many governments temporarily short-circuited their existing systems because they were too slow. In Estonia and Singapore digital-identification systems and a disdain for form-filling became an asset in the crisis. More countries need to copy them and also to ensure universal access to the internet and bank accounts. The call for efficient administration may sound like tinkering but one in five poor Americans eligible for wage top-ups fails to claim them. Nimbler digital-payment systems will reduce the need for costly universalism as a fail-safe, and allow better targeting and quicker response times. Digital systems also permit the emergency option of making temporary cash payments to all households.

实现目标的第一步是利用科技提高古老官僚机构的效率。邮政转账支票、上世纪八十年代的主机、垃圾数据应该成为历史。在大流行期间,许多政府临时避开现有系统,因为它们太慢了。在爱沙尼亚和新加坡,数字识别系统和鄙弃填写表格成为这场危机的财富。更多的国家应该效仿它们,还要确保互联网和银行账户的普及。提高行政效率的诉求似乎无关痛痒,但五分之一有资格加薪的美国穷人申请不到。有了更灵活的数字支付系统,就没必要为了保险起见采取昂贵的普遍主义做法,针对性更强,响应速度更快。在紧急情况下,数字支付系统还能向所有的家庭发放临时现金。

That is the easy part. Balancing generosity and dynamism is harder. Part of the solution is to top up the wages of low-paid workers. Anglo-Saxon countries have done this well since reforms in the 1990s and 2000s. But wage top-ups are of little use to the jobless and are often scant compensation for people who lose good jobs to forces beyond their control. Paltry support for the unemployed in Britain and America preserves incentives to work but at high human cost. The sparsity of social insurance has undermined political support for creative destruction, the catalyst for rising living standards. Continental Europe tends to underwrite traditional workers’ incomes more generously. But the distortion of incentives leads to higher unemployment and divisions between coddled insiders and a precariat. Both sides of the Atlantic lack a permanent safety-net that insures gig workers and the self-employed.

这是容易的一面,难点是在慷慨与活力之间取得平衡。其中一个解决方案是给低收入工人加薪,自上世纪90年代和本世纪初实施改革以来,盎克鲁-撒克逊国家在这方面一直做得很好。但是,加薪对于失业人员来说没用,对于因不可抗力而失去好工作的人来说不够用。英国和美国给予失业人员的救济微不足道,虽然保住了他们的工作动力,但耗费了很高的人力成本。低水平的社会保障削弱了创造性破坏在政治上得到的支持,后者是提高生活水平的催化剂。欧洲大陆倾向于更慷慨地为传统工人的收入提供保障,但激励扭曲会导致更高的失业率,并且在被溺爱的内部人士与不稳定无产者之间形成对立。大西洋两岸缺少针对临时工和个体经营者的长期保障体系。

There is one country that combines labour-market flexibility with generosity: Denmark, which spends large sums—1.9% of gdp in 2018—on retraining and on advising the jobless. These interventions stop the unemployed from falling into dependency. The inadequacies of policies elsewhere are often glaring. Britain’s efforts have flopped. America’s comparable spending is less than a 20th as large as Denmark’s, even though the few lucky beneficiaries of its “trade-adjustment assistance” earn $50,000 more in wages, on average, over a decade.

有一个国家结合了劳动力市场的灵活与慷慨:丹麦耗费巨资——2018年达到GDP的1.9%——为失业人员提供再培训和和咨询,这些干预措施避免了失业人员产生依赖。其他国家的政策明显不完备,英国彻底失败,美国的类似支出不到丹麦的二十分之一,只有少数幸运的“贸易调整援助”受益者十年来的平均工资达到5万美元以上。

Bungee economics

蹦极经济学

For years social spending has favoured the elderly and an outdated safety-net. It should be rebuilt around active labour-market policies that use technology to help everyone from shopworkers who are victims of disruption to mothers whose skills have atrophied and those whose jobs are replaced by machines. Governments cannot eliminate risk, but they can help ensure that if calamity strikes, people bounce back.

多年以来,社会支出一直侧重于老年人和落后的保障体系。国家应当围绕积极的劳动力市场政策重建保障体系,利用技术帮助每一个人:成为技术颠覆牺牲品的店员、工作技能退化的母亲、工作被机器抢走的工人。政府无法杜绝风险,但有助于确保当灾难降临时,人们能够重整旗鼓。

评论