中国之于供应商:既爱又恨

点击蓝字关注我

让MOI每天以不同的形态陪伴在你身边

Loving China, leaving China

A look at where clothes, cars and computers are made reveals differing patterns of supply fragmentation

中国一度是世界工厂,承接各行各业的加工,各国的商品上,也都赫然印着“中国制造”。然而随着时间的流逝,这一切都在发生变化。曾经深受各大企业热捧的加工地——中国,如今也不得不面临人去楼空的情形,这却并不意味着衰败。

Globalisation is becoming regionalisation. Analysis by MGI finds that the global value chains (GVCS) in 16 of 17 big industries it studied have been contracting since the global financial crisis. Trade continued to grow in absolute terms from 2007 to 2017, but during that period exports in those same value chains declined from 28.1% to 22.5% of gross output. The biggest declines in trade intensity were observed in the most heavily traded and complex GVCS, such as those in clothing, cars and electronics. As MGI’s Susan Lund explains, “more production is happening in proximity to major consumer markets.”

全球化(globalisation)正在变得地域化(regionalisation)。根据MGI的分析,他们研究的17个较大的行业中有16个全球价值链(value chain)都在收缩(contract)。2007年到2017年,贸易持续绝对(in absolute terms)增长。但在此阶段同样的出口价值链总产量(gross output)从28.1%下降到22.5%。贸易强度下滑幅度最大的是那些曾大量贸易而且很复杂的价值链。比如服装、汽车和电子产品。Susan说,更多的生产发生在主要的消费者市场(consumer markets)附近。Proximity to 邻近

China’s role as the world’s workshop is starting to fade, but surprisingly this may not sound the death knell for mainland manufacturing. Thanks to its skilled labour force and excellent infrastructure, China remains an outstanding place to make things, hence its continued strength in numerous sectors (see chart on next page). Also, the rise of the Chinese middle class has led many firms to redirect production to serve the local market. So MNCS are clearly rethinking the old linear sourcing model for Western markets, but the path forward is unclear. Different industries will make different choices.

中国作为世界工场(workshop)的角色正在开始消退(fade),但奇怪的(surprisingly)是这并不是大陆制造业(mainland manufacturing)的丧钟(the death knell)。多亏了(thanks to)有娴熟的(skillful)劳动力(labour force)和优质的基础设施(excellent infrastructure),中国仍然是制造业的杰出选地(outstanding place),所以在很多领域(numerous sectors)仍有强大的竞争力(strength)。同时,中国中产阶级(middle class)的崛起(rise)让很多公司重新定位(redirect),让生产服务于本地市场(local market).。所以跨国公司(MNCS)都在重新思考(rethink)为西方市场设定的旧的线性外包模型(linear sourcing model),但前景仍不清晰。不同的行业会有不同的选择。

Corporate supply-chain data are often opaque and official trade statistics typically lag by years. Yet talking to many firms in three industries reveals different patterns of fragmentation. The clothing sector is globally footloose; the car industry is coalescing around regional hubs; and the electronics business remains rooted in China (though Mr Trump’s attack on Huawei, its technology champion, will affect this).

公司供应链(supply-chain)数据通常都是透明的(opaque),官方贸易数据也总是滞后(lag)多年。然而与三大行业的公司交谈揭示不同形式的分崩离析(fragmentation)。服装行业全球无拘无束(footloose);汽车行业正围绕区域中心(regional hubs)进行合并(coalesce);电子行业在中国根深蒂固(rooted)。(尽管特朗普攻击技术桂冠华为会对此有一定影响。)

Big parts of the clothing and footwear business involve labour-intensive tasks such as stitching, so cost-conscious bosses are always chasing low-cost markets. Many long ago left the mainland, where wages have soared, for South-East Asia and Bangladesh. Nike and Adidas make more training shoes in Vietnam than China.

服装和鞋类(footwear)的主要工作(big parts)涉及(involve)劳动密集型(labour-intensive)任务(task),比如缝线(stitching),所以注重成本的(cost-conscious)老板们总是追逐(chase)低成本(low-cost)市场(market)。很多企业多年前就离开了大陆,去到(leave...for)东南亚(South-East Asia)和孟加拉国(Bangladesh),因为大陆的工资(wage)飞涨(soar)。耐克和阿迪达斯在越南生产更多的运动鞋。

Today’s hot spot is Ethiopia, which has attracted investment by Calvin Klein and H&M. With labour costs of just $26 a month, it might seem a dream destination for the frugal clothier. But a report released in May by the NYU Stern Centre for Business and Human Rights argues that these wages are too low to meet workers’ basic needs, which is fuelling unrest. Productivity levels are low and attrition high. Paul Walsh of Newtimes Group, a clothing supply-chain firm, observes: “We’ve run out of magic countries.”

现在的热点(hot spot)是埃塞尔比亚(Ethiopia),它吸引了CK和H&M的投资。在这里,劳动力一个月只需要26美金,让这个国家成为节俭的(frugal)医料商(clothier)最理想的目的地(dream destination)。但是一份五月的报告争论说这些工资低到无法满足工人的基本需求(meet worker’s basic needs),这会引起动荡不安(fuel unrest)。生产力水平很低,消耗(attrition)却比较高。新时代集团服装供应链公司的PaulWalsh 观察后说,“我们正在让那些神奇的(magic)国家消耗殆尽(run out of)。”

Clothing bosses are increasingly preoccupied with speed more than cost, says Suresh Dalai, a supply-chain expert based in Asia. “In speed, China still has the edge,” he says, pointing to its world-beating online retailers, “social-commerce” innovators and nimble manufacturers. He thinks that demanding local consumers force Chinese clothing factories to remain enterprising and flexible. In contrast, factory bosses elsewhere complain of unreliability and low productivity.

服装业的老板们正在忙于(be preoccupied with)速度而非成本,一个亚洲的供应链专家说道。“在速度方面(In speed),中国仍然有优势(have the edge)。”他说,指向(point to)举世无双的(world-beating)网上零售商(online retailers),社会化商业服务(social-commerce)创造者(innovators)和敏捷的(nimble)制造商(manufacturers)。他认为苛刻的(demanding)当地消费者强迫(force)中国服装厂家(Chinese clothing factories)有进取心(enterprising)且很灵活(flexible)。相反(In contrast),其他地方的厂家老板都抱怨(complain)不可靠(unreliability)和低生产力(low productivity)。

Unlike those cut-rate competitors, say experts, Chinese factories have specialised machinery and experienced operators that are needed to make seamless fabrics and other higher-value textiles. Pravin Rangachari of Haggar, a leading manufacturer of men’s trousers, has no plans to abandon China’s highly automated fabric mills, which he finds “very competitive”. He adds that compliance with child-labour laws is strong in China, which cannot always be said about other markets.

不像那些减价的(cut-rate)竞争者(competitors),中国厂家有专业的机械和有经验的操作者(experience operators)来制作无缝面料(seamless fabrics)和其他高产值(higher-value)纺织品(textile)。一个生产男士裤子的领军生产商(leading manufacturer)并没有计划(have no plan to do)放弃(abandon)中国高度自动的(highly automated)布厂(fabric mills),认为这些布厂很有竞争力(competitive)。他还说遵守(compliance with)童工法(child-labour law)在中国很受重视,在其他市场却不见得如此。

China’s share in big clothes-importing markets such as Japan and Europe has declined since 2010 as they have been buying cheaper clothes made in South-East Asia instead. However, China’s share in every big textile-import market in Asia has soared because many of those workshops still bought fabrics from the mainland. Its export share into Vietnam, for example, more than doubled to 50% from 2005 to 2017. The upshot is that although China’s once-dominant role in this industry has diminished, it remains strong in important niches.

中国在大型服装进口市场(clothes-importing markets)如日本和欧洲的份额(share)从2010年以来就在下降(decline),因为他们一直从东南亚购买更便宜的服装。但是,因为很多作坊仍然从大陆购买布料,中国在亚洲大型纺织品进口市场的份额飞升(soar)。出口到越南的份额从2005年到2017年翻了一番,达到50%。最终结果(upshot)是尽管中国曾经的主导地位(once-dominant role)已经在削减(diminish),势头仍然强劲(important niches)。

As for the automobile industry, its supply chains have both local and global dimensions. “Except for the jack in the trunk, which everybody gets from China, we’ve had a distributed global supply chain for a long time,” says Hau Thai-Tang, Ford’s top supply-chain executive. He sees a trend towards greater regionalisation coming with three hub-and-spoke networks: Mexico as the low-cost spoke for America; eastern Europe and Morocco for western Europe; and South-East Asia and China for Asia.

对于汽车行业,供应链有当地和全球维度(dimension)。“除了后备箱(trunk)里的起重器(jack)是从中国买入的,我们一直从世界各地供应货源(have a distributed global supply chain)。”福特的顶尖供应链执行官说。他看到了随着三个中心辐射型网络而来的更大的地域化(regionalisation)。墨西哥是美国的低成本(low-cost)轮辐(spoke)。东欧和摩洛哥是西欧的轮辐,东南亚和中国是亚洲的轮辐。

One reason for regionalisation is that the American market is diverging from global trends, argues Kristin Dziczek of America’s Centre for Automotive Research, an industry-research outfit. The Trump administration has rejected carbon regulation and rolled back Obama-era rules promoting more fuel-efficient vehicles. Americans are increasingly favouring pickup trucks and sports-utility vehicles, gas guzzlers eschewed by much of the rest of the world. This has big implications. Ford has decided to phase out saloons altogether in its home market, for example, while GM has left Europe and is consolidating its North American operations.

地域化的一个原因就是美国市场正在从全球趋势中分离出来。特朗普证券拒绝碳排放量规则,把节能车压低到奥巴马时代的标准水平(roll...back)。美国人正在加大力度支持小货车(pickup trucks)和运动型多用途车(sports-utility vehicles),燃油机车(gas guzzlers)等被世界其他地方日渐回避(eschew)的选择。这有着很强的暗示性。福特决定逐步淘汰(phase out)国内市场的轿车(saloons),而通用公司正在离开欧洲,巩固(consolidate)与北美的关系。

Good night, Shanghai

晚安,上海

Car firms have invested heavily to turn Mexico into an export base. The value of its automobile exports has more than doubled since 2010, approaching $50 bn last year. The main reasons are not the nearly-defunct North American Free Trade Agreement or lower labour costs, but rather Mexico’s four dozen free-trade agreements with other countries which allow it to export to almost half the world’s market for new cars tariff-free. Carmakers have rejigged supply lines to take advantage. Mexico’s car exports to Germany have nearly 40% German components by value, while those crossing its northern border have over 70% American content.

汽车公司已经投入巨资(invested heavily)让墨西哥变成出口基地(turn...into export base)。汽车出口值从2010年以来就翻番了,去年已经接近500亿美元。主要原因并不是几乎失灵的(nearly-defunct)北美自由贸易协定(North American Free Trade Agreement)或者更低的劳动力成本(lower labour cost),而是墨西哥与其他国家的48个(four dozen)自由贸易协定,允许汽车免税(tariff-free)出口到世界几乎一半的市场。汽车制造商重新安排(rejig)供应线来占据优势(take advantage)。墨西哥出口到德国的汽车中德国配件(German components)价值占到40%,而那些穿越北部边界(crossing its northern border)的汽车涵盖70%的美国部件。

Mr Trump’s tariffs on China have pushed Big Auto’s supply chains to become even more regional. “We’re finally ready to leave China,” says a senior supply-chain executive at a global car maker.

特朗普对中国征收的税推动Big Auto公司的供应链成为更地域性的(regional)公司。“我们已经准备好要离开中国。”一个全球汽车制造商的资深(senior)供应链执行官说。

His firm is looking seriously at shifting its sourcing for the global market from China to India, but finds Indian vendors “unreliable”. It thought about dividing between India and Mexico, but saw that its supply base would lose economies of scale. The winner will be Mexico, he says.

他的公司正很严肃的看是否能将其全球市场的采购从中国转到印度,但是发现印度商贩“不可信赖”(unreliable)。他们也思考过将印度和墨西哥分离开,但看到供应基地将会失去大规模的经济体。“赢家将会是墨西哥。”他说。

A longer-term force that could turn automotive supply chains upside down is electrification. The Edison Electric Institute, a think-tank, estimates that the share of electric vehicles (EVS) in new car sales in America will rise from 2% in 2018 to over 20% in 2030. That could reduce trade in parts dramatically, since EVS have many fewer moving parts than conventional cars. Ford calculates that a shift to electric would reduce the value added by branded car manufacturers from 30% to 10%.

将整个汽车供应链翻转(upside down)的长远力量(a longer-term force)就是电气化(elctrification)。爱迪生电气研究所智囊团(think-tank)估计说电动汽车(electric vehicles EVS)在美国的销售将会从2018年的2%上升到2030年的20%。因为电动汽车比传统汽车(conventional cars)有更少的零部件,这可能会导致零部件的贸易大量(dramatically)减少。福特计算(calculate)转变(shift to)到电动汽车将会导致品牌汽车制造商增加的值从30%降到10%。

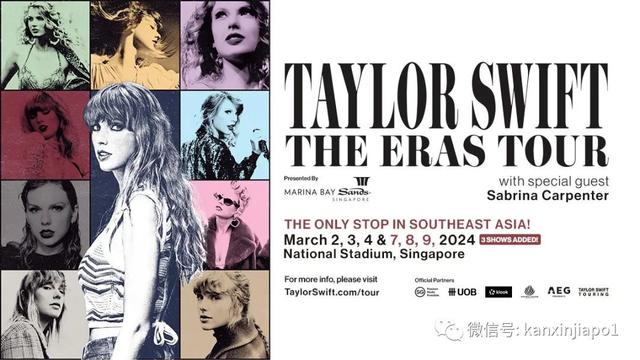

Dyson, a British engineering firm, is now designing and manufacturing its new EVS in Singapore to be close to China. This is not just because the mainland is the biggest market for such vehicles. It is also the beating heart of global electronics production.

戴森是一家英国的公司,现在正在新加坡设计并制造新的电动汽车,邻近中国。这不仅仅是因为大陆是这样的汽车的最大市场,也是全球电子产品的心脏(beating heart)。这一句形象地用beating heart 描述中国电子产品地活跃程度。

Innovation nation

创新国家

Half the world’s electronics-manufacturing capacity is based on the mainland. Its strengths go beyond sheer scale to diversity and sophistication of products. The pace of hardware innovation in China’s Pearl river delta is unmatched even in Silicon Valley. So, too, is its unique blend of scale and agility. This is why most of the world’s technology giants make their kit in China.

世界一半地电子产品制造产能(electronics-manufacturing capacity)基于(is based on)中国大陆。其优势早已不是规模大这么简单,还有产品的多样性(diversity)和精密程度(sophistication)。中国珠江三角洲地硬件创新能力已经让硅谷都无法媲美(unmatched),还有其独特(unique)的规模(scale)与灵敏性(agility)混杂特色。

Rising costs led some electronics firms to consider moving out a few years ago. Most notably, Samsung has built a huge smart-phone-manufacturing complex in Vietnam. Now the political risks associated with sourcing from China, especially the Huawei crackdown, are causing others to consider leaving. GoPro, which makes rugged digital cameras, is shifting much of its production to Mexico. Stanley Black & Decker, a big toolmaker, is moving production of its Craftsman brand of tools back to American manufacturing in anticipation of a boom in 5G telecoms-equipment sales.

几年前成本增加导致一些电子公司考虑搬出。最显著的是(most notably),三星已经在越南修建了大型智能手机制造综合体(smart-phone-manufacturing complex)。现在与中国采购相关的政治风险,特别是华为受到的打击(crackdown), 都导致其他厂家考虑离开中国。GoPro制作坚固耐用的(rugged)数码相机,正将其生产转移到墨西哥。Stanley Black & Decker, 是一个很大的工具制造商,正将其手艺人品牌的工具生产转移到美国制造,期望(in anticipation of)5G电信设备销售(5G telecoms-equipment)的繁荣(boom)。

Many firms are discovering that leaving China is not so easy. John Kern is the head of supply chains at America’s Cisco, a telecoms-equipment company. Because of the concerns of customers in America and India who want non-China sourcing, it has upgraded its Mexican operations. But it still has many global customers without such concerns. He says China is a big manufacturing base for Cisco and “will remain so for many years to come”.

很多公司发现离开中国没那么容易。John Kern 是美国Cisco 电信设备公司供应链的领军人物,因为担心美国和印度需要非中国产地的产品,已经换上了墨西哥的整套装备。但还是有很多全球顾客并没有这样的担忧。他说中国是Cisco很大的一个制造基地,而且将继续这样很多年。

George Yeo of Kerry Logistics, which has lorries and men all over Asia, has noticed an uptick in clients investing in South-East Asia. Vietnam and Cambodia are the biggest beneficiaries, he reports. But labour productivity is a big problem across the region and infrastructure can be ropey. Much of the investment he sees is going into labour-intensive industries like textiles. In electronics, Mr Yeo thinks the exodus is limited to low-end kit. “Thanks to automation and high value-add, Shenzhen is still king.”

George Yeo来自Kerry物流公司(logistics),在亚洲有很多货运汽车(lorry)和工人,注意到客户在东南亚的投资有小幅增加(uptick)。越南和柬埔寨都是最大的受益者(beneficiary)。但劳动者生产力(labour productivity)是整个地区的大问题,基础设施也很劣质(ropey)。他看到很多投资都进入劳动力密集型的行业,比如纺织业。在电子行业,Yeo 认为只有低端的(low-end)配套原件(kit)等行业才有大量的人员流失(exodus)。“多亏了(thanks to)有自动化(automation)和高附加值(high value-add),深圳依然领先(king) 。”

Scrutiny of these three sectors suggests a messy path forward from globalisation. Making this challenge more acute, MNC bosses are now faced with a double threat. Not only must they make supply chains shorter, they must make them faster.

仔细审视(scrutiny)这三个行业,会发现全球化的混乱(messy)路径。更严重地讲(making this challenge more acute),跨国公司老板们现在面临着双重威胁(double threat),他们不仅仅要让供应链更短,还要让他们更快。

想要和我们的《经济学人》主持人进行深度讨论,或是获取最新的《经济学人》杂志,请添加微信museumofideas,并注明“经济学人交流”。也欢迎大家在文末留言!

Creator:Julia

Editor:Tony

Copyreader:Julia

Designer:Jasper

评论